AIS AND TIS Explained

Filing taxes can often feel overwhelming, especially with multiple income sources and tax deductions. To make this process easier, the Income Tax Department introduced two important tools: Annual Information Statement (AIS) and Taxpayer Information Summary (TIS). These statements provide a clear, detailed, and organized view of a taxpayer’s financial transactions, helping them file accurate tax returns with ease.

If you’re a taxpayer, understanding AIS and TIS can help you ensure compliance, avoid tax mismatches, and reduce errors in tax filings. Let’s break down these tools in detail.

What is AIS (Annual Information Statement)?

AIS (Annual Information Statement) is a detailed financial report that includes all income sources, taxes deducted, and other relevant financial transactions for a financial year. This statement is automatically generated by the Income Tax Department and is available on the Income Tax e-Filing portal.

What Does AIS Include?

AIS covers a wide range of financial transactions, such as:

- Salary Details – Information about salary received, allowances, and deductions.

- Interest Income – Interest earned from savings accounts, fixed deposits, recurring deposits, etc.

- Dividend Income – Dividends earned from stocks and mutual funds.

- Capital Gains – Profits or losses from selling shares, mutual funds, real estate, or other assets.

- TDS (Tax Deducted at Source) – The tax deducted on salary, fixed deposits, interest, or dividends.

- TCS (Tax Collected at Source) – Tax collected on certain high-value transactions like foreign remittances, luxury purchases, and sale of goods.

Why is AIS Important?

AIS helps taxpayers by:

- Ensuring Accurate Tax Filing – Avoids missing any income while filing returns.

- Reducing Compliance Burden – No need to manually track income and tax deductions.

- Enhancing Transparency – Provides a clear financial summary directly from the Income Tax Department.

What is TIS (Taxpayer Information Summary)?

While AIS provides detailed financial information, TIS (Taxpayer Information Summary) gives a simplified summary of the same data. It is designed for quick reference, so taxpayers can review their key financial details before filing their returns.

What Does TIS Include?

TIS contains a concise version of AIS, summarizing:

- Total Income – Salary, interest, dividends, and capital gains.

- TDS & TCS – Tax deducted and collected on various transactions.

- Tax Payments – Taxes paid by the taxpayer throughout the year.

Why is TIS Important?

- Quick Overview – Helps taxpayers quickly check their income and tax details.

- Simplified Compliance – Reduces confusion by summarizing AIS data.

- Prevents Errors – Helps identify and fix mismatches before filing tax returns.

How to Access AIS and TIS?

If you’re a taxpayer, checking AIS and TIS before filing your return can help you avoid errors and ensure accuracy. Here’s how you can access them:

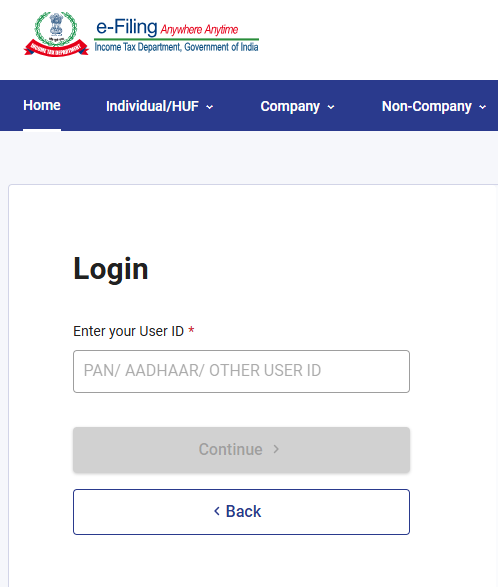

1️⃣ Login to the Income Tax Portal (https://www.incometax.gov.in/) using your PAN and password.

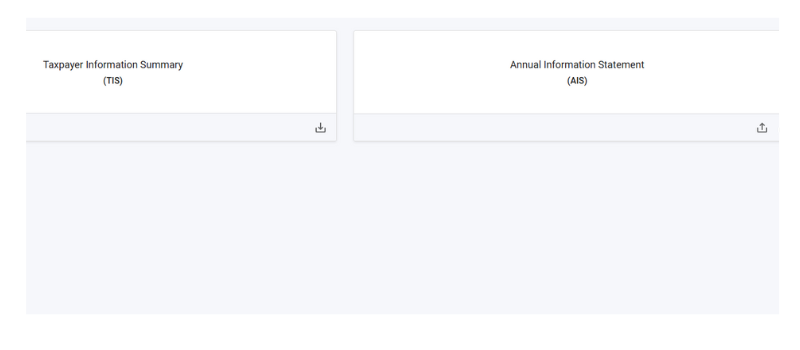

2️⃣ Navigate to the AIS/TIS Section in the e-filing portal.

3️⃣ View & Download your AIS and TIS reports to cross-check your tax details.

The Risk of Not Using AIS and TIS

Many taxpayers forget to check their AIS and TIS, leading to:

🚫 Mismatched Income Reporting – If AIS reports more income than what you declare, you might get a notice from the Income Tax Department.

🚫 Incorrect Tax Deductions – Missing out on TDS credits can lead to higher tax liability.

🚫 Increased Compliance Issues – Errors in tax filing can result in penalties and scrutiny.

To avoid unnecessary issues, always verify your AIS and TIS before filing returns.

Important things you should keep in mind before filing IT return

Final Thoughts: Why AIS & TIS Matter for Every Taxpayer

The AIS and TIS are powerful tools that simplify tax compliance by providing a clear, structured, and transparent view of income and taxes. Whether you’re a salaried individual, investor, or business owner, these statements ensure:

✔ More accurate tax filing

✔ Fewer errors and compliance issues

✔ Better financial tracking and planning

By making use of AIS and TIS, taxpayers can stay informed, avoid tax mismatches, and ensure a smooth tax-filing process every year. If you haven’t checked your AIS and TIS yet, it’s time to log in to the Income Tax Portal and do it today!