If you are a salaried employee, you have likely come across Form 16—an important document that plays a key role in your income tax filing. But what exactly is Form 16, and how do you interpret the details it contains? In this guide, we’ll break down everything you need to know about Form 16, its components, and why it is crucial for tax compliance.

What is Form 16?

Form 16 is a certificate issued by an employer to an employee, summarizing the Tax Deducted at Source (TDS) from the employee’s salary. It serves as proof that the employer has deducted and deposited taxes on behalf of the employee with the government.

Who Issues Form 16?

Employers issue F 16 to their employees every financial year. It must be provided on or before June 15th of the following financial year.

Understanding the Structure of Form 16

Form 16 is divided into two parts: Part A and Part B.

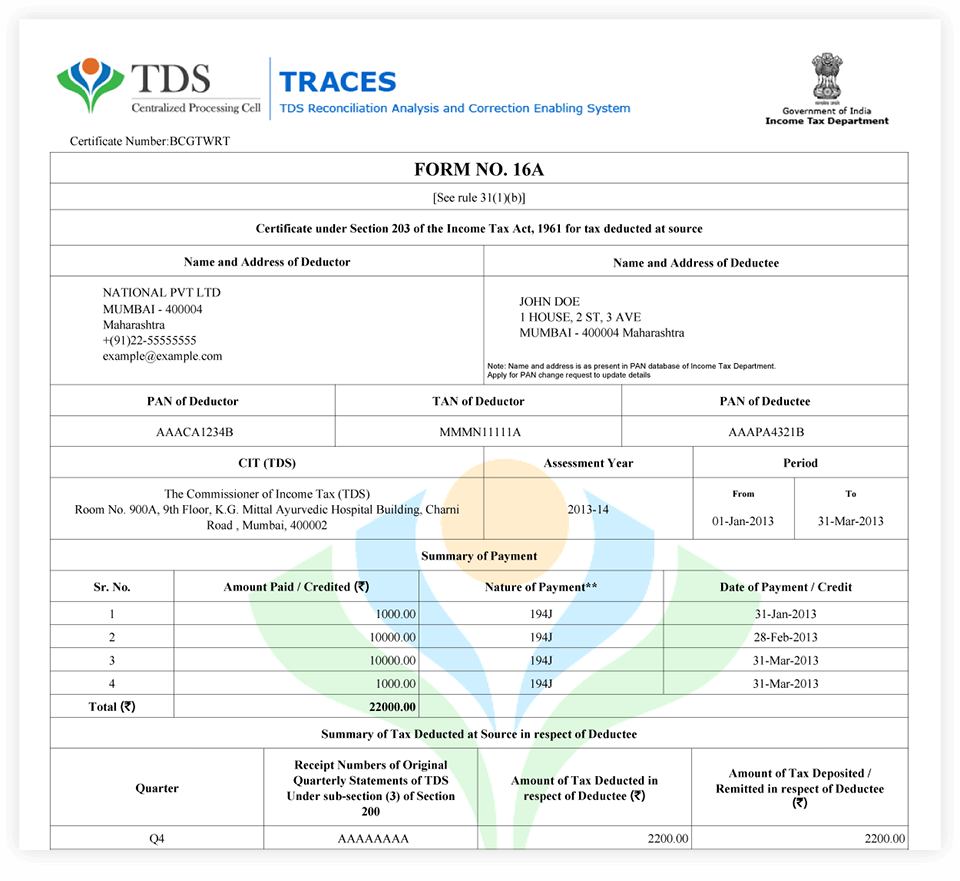

Part A – TDS Certificate

This section provides details related to tax deduction and employer-employee identification. It includes:

1. TAN (Tax Deduction and Collection Account Number) – Employer’s TAN, which is required for tax deduction.

2. PAN (Permanent Account Number) – Both the employer’s and the employee’s PAN.

3. Employer and Employee Details – Name and address of both the employer and the employee.

4. Period of Employment – The duration for which the employee worked with the employer in the given financial year.

5. Summary of TDS Deductions – The amount of tax deducted from the employee’s salary and deposited with the government.

Part B – Salary Details and Tax Computation

This section provides a detailed breakdown of salary and tax deductions. It includes:

1. Salary Components – Basic salary, allowances, bonuses, and other benefits.

2. Exemptions Under Section 10 – Exemptions such as HRA (House Rent Allowance), LTA (Leave Travel Allowance), and other benefits.

3. Deductions Under Chapter VI-A – Tax-saving deductions under sections like:

• 80C (Investments in PPF, EPF, Life Insurance, etc.)

• 80D (Health insurance premium)

• 80E (Education loan interest)

4. Net Taxable Income – After considering salary, exemptions, and deductions, this is the final amount on which tax is calculated.

5. TDS Details – The total tax deducted from the employee’s salary.

How to Read and Verify Your Form 16?

Follow these steps to ensure accuracy in your F 16:

1. Check Personal and Employer Details – Verify your name, PAN, employer’s TAN, and address to avoid discrepancies.

2. Review Salary and Deductions – Ensure that your salary breakdown and claimed deductions (such as 80C, 80D) are accurately reflected.

3. Cross-check TDS Amount – Match the TDS deducted with the amount deposited as per your Form 26AS (available on the Income Tax e-filing portal).

4. Look for Errors – If you find any mistakes in your F16, notify your HR or employer immediately for corrections.

Why is Form 16 Important?

Form 16 is a crucial document for various purposes:

1. Filing Income Tax Returns (ITR) – It simplifies the tax filing process by providing all relevant details in a structured format.

2. Tax Planning – Helps in understanding taxable income, exemptions, and deductions to plan your taxes better.

3. Loan and Visa Applications – Banks and financial institutions often ask for F16 as proof of income for loans and visa applications.

Frequently Asked Questions (FAQs)

- When will I receive Form No.16?

Your employer is required to issue F16 by June 15th of the following financial year.

- Can I file my tax return without Form 16?

Yes, you can still file your ITR by using Form 26AS and salary slips to determine your income and TDS details.

- What if there is an error in Form 16?

In case of discrepancies, you should immediately contact your employer or HR department for corrections.

- Is Form 16 applicable to all employees?

No, only employees whose TDS has been deducted by their employer will receive F16. If no tax has been deducted, the employer may not issue it.

Important things you should keep in mind before filing IT return for F.Y. 2022-23

Conclusion

Form 16 is an essential document that simplifies tax filing and helps in tax planning. Understanding its components ensures that you file accurate tax returns and avoid future tax-related issues. Always review your Form 16 carefully, verify details, and address discrepancies promptly to ensure smooth tax compliance.

By staying informed, you can take better control of your taxes and financial planning!