With the rollout of the Goods and Services Tax (GST), the way services are exported from India has seen some important changes. If you’re a freelancer, consultant, or company dealing with international clients, understanding GST implications on the export of services is crucial for compliance and financial planning

What is an Export of Services under GST?

As per Section 2(6) of the IGST Act, 2017, a service is considered an export if it meets the following five conditions:

- The supplier of service is located in India

- The recipient of service is located outside India

- The place of supply is outside India

- The payment is received in convertible foreign exchange or in Indian Rupees where permitted by RBI

- The supplier and recipient are not merely establishments of the same person (i.e., not just branch offices of the same entity)

If all these conditions are met, it’s treated as a zero-rated supply under GST.

Export of services is considered a zero-rated supply, which means GST rate is 0%. As a result, no GST is payable on export of services. Zero GST rate on export of services makes Indian service providers more competitive in the global market. Exporters of services don’t need to pay GST, which simplifies compliance and reduces paperwork.

What is a Zero-Rated Supply?

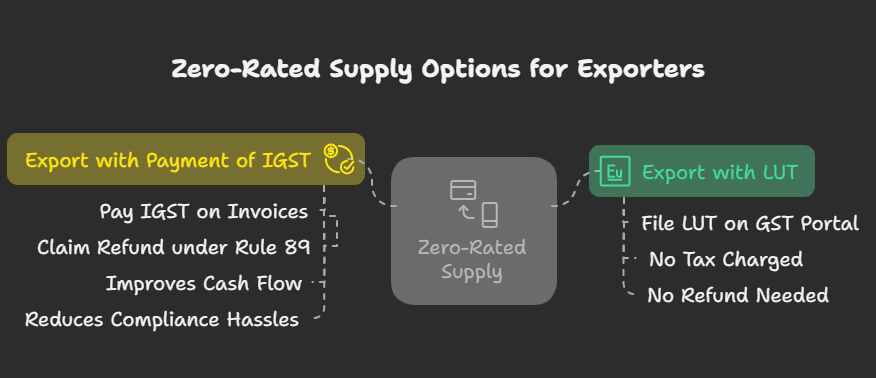

Zero-rated supply means no GST is applicable on the transaction. But that doesn’t mean the process is tax-free by default. Exporters have two options:

1. Export with LUT (Letter of Undertaking) ? / LUT Certificate

- You can export services without paying IGST

- Must file LUT on the GST portal

- No tax is charged, and there is no need to claim a refund for IGST

2. Export with Payment of IGST

- Pay IGST on export invoices

- Later claim a refund of the tax paid under Rule 89 of the CGST Rules

Most exporters prefer the LUT route as it improves cash flow and reduces compliance hassles.

Input Tax Credit (ITC) on Export of Services

Even if no GST is charged on the export invoice, the exporter can claim ITC on input services and goods used for providing those export services. This ITC can be:

- Claimed as a refund (if exporting under LUT), or

- Offset against output IGST (if exporting with tax payment)

What is an LUT under GST?

A Letter of Undertaking (LUT) is a document that allows certain GST-registered businesses to export goods or services without paying Integrated Goods and Services Tax (IGST). If you’re an exporter or provide services internationally, understanding LUT under GST is essential. It can save you from locking up working capital in taxes. But what exactly is an LUT? Let’s break it down.

LUT stands for Letter of Undertaking. It is a document that exporters can file to export goods or services without having to pay IGST (Integrated Goods and Services Tax). Under Rule 96A of the CGST Rules, any registered taxpayer who exports goods or services can furnish an LUT in Form GST RFD-11, thereby avoiding the need to pay IGST upfront and then claim a refund.

Who Can File an LUT?

The following taxpayers can file an LUT:

- Exporters of goods or services

- Suppliers to SEZs (Special Economic Zones)

- Deemed exporters (in certain notified cases)

However, this benefit is available only to those who have not been prosecuted for any offence under GST or any existing law involving tax evasion of ₹250 lakh or more

Why is LUT Beneficial?

Filing an LUT is a smart move for exporters:

- If LUT is filed then there is no need for upfront payment of IGST. This helps in easing cash flow issues.

- Without an LUT, you’d have to pay IGST and then apply for a refund – a time-consuming process. Filing LUT enables faster process than refund route.

- LUT is filed on yearly basis. Once approved, an LUT is valid for the whole financial year.

How to File LUT Online?

Filing LUT under GST is quick and simple via the GST portal:

- Login to the GST portal – https://www.gst.gov.in/

- Go to: Services > User Services > Furnish Letter of Undertaking (LUT)

- Select the financial year and fill the required details

- Upload supporting documents, if any

- Submit with DSC (Digital Signature Certificate) or EVC (Electronic Verification Code)

Once submitted, you’ll receive an acknowledgement and can download the filed LUT for your records.

Important Points to Remember for Key Compliances

- LUT needs to be filed every financial year.

- If LUT is not filed, the exporter will have to pay IGST and claim a refund later.

- LUT is not applicable for supplies made to domestic customers.

- Maintain proper documentation w.r.t. export invoices, foreign inward remittance certificates, contracts

- Filing of returns must be done on timely basis following the respective due dates for GSTR-1, GSTR-3B, and refund claims if applicable

- Ensure receipt of payment in foreign currency or INR as permitted by RBI, within prescribed timelines

Common Mistakes to Avoid while filing LUT

- Not renewing the LUT each year

- Assuming export automatically means no compliance

- Delay in receiving export proceeds (can make the export taxable)

- Not maintaining proper documentation for audit or refund claim

Conclusion

Export of services under GST offers significant benefits, especially being zero-rated, but requires careful compliance. Filing an LUT, maintaining records, and understanding refund mechanisms are all part of the game. Whether you’re a small freelancer or a large agency, staying GST-savvy helps you keep operations smooth and tax-efficient. It is always advisable to consult a GST professional to get personalized advice on GST implications for export of services and ensure compliance with GST laws and regulations.