The Indian tax system has undergone significant changes in recent years, especially with the introduction of the new tax regime. With the recent Union Budget 2025 takeaways and as we approach the financial year 2025-26, taxpayers must evaluate whether the old or new tax regime is more beneficial for them. The decision hinges on various factors, including income levels, deductions, exemptions, and individual financial goals.

Tax Slab Comparison

Note: Under OLD tax regime Senior citizens (60–80 years) have a basic exemption limit of ₹3,00,000, and super senior citizens (80+ years) have ₹5,00,000.\

Understanding the Two Tax Regimes

Old Tax Regime

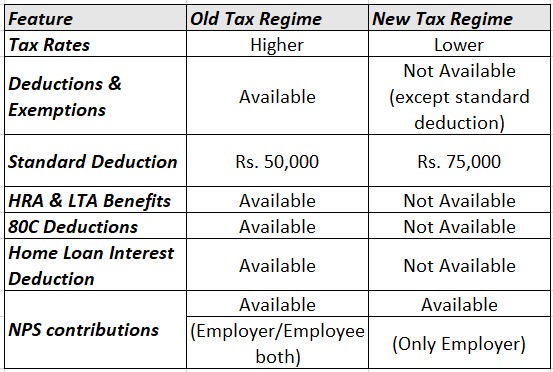

The old tax regime follows a slab-based structure where taxpayers can claim multiple deductions and exemptions under the Income Tax Act, 1961. Some of the commonly used deductions include:

- Section 80C: Deductions up to Rs. 1.5 lakh for investments in PPF, EPF, ELSS, life insurance, and more.

- Section 80D: Health insurance premium deductions up to Rs. 25,000 (Rs. 50,000 for senior citizens).

- HRA (House Rent Allowance) and LTA (Leave Travel Allowance) exemptions.

- Standard Deduction of Rs. 50,000 for salaried individuals.

- Home Loan Interest Deduction under Section 24(b) up to Rs. 2 lakh.

Old tax regime has higher tax rates as compared to the New tax regime. It requires much detailed tax planning. The individuals who intend to go with investments and tax savings instruments can opt for the Old regime.

New Tax Regime

The new tax regime offers lower tax rates but eliminates most exemptions and deductions. Additionally, the new regime has a standard deduction of Rs. 75,000 for salaried individuals. New regime gives a simplified version for tax calculations. Under the new regime, only the employer’s contribution to NPS qualifies for a tax deduction. Own contributions to NPS do not offer tax benefits under the new regime.

Key Differences Between the Old Tax Regime vs New Tax Regime

Key Benefits Of The New Tax Regime For The Year 2025-2026

1.Under the new regime, salaried individuals can enjoy zero tax liability on annual incomes up to ₹12.75 lakh.

2.The new regime eliminates the need for multiple exemptions and deductions, making tax calculations straightforward.

3.The revised tax slabs under the new regime are more favorable for many taxpayers:

Example Calculations

Below chart shows how income and deductions make an impact on tax payable amounts. Selection of regime depends upon individual choices of tax investments and their respective income range.

Which One is Better for You? (Old Regime vs New Regime)

The choice between the old and new regimes depends on individual circumstances and tax planning strategies. Here’s a guide to help you decide:

Choose the Old Tax Regime If:

- You claim multiple deductions like 80C, 80D, HRA, and home loan interest.

- You have significant tax-saving investments like EPF, PPF, NPS, and insurance policies.

- Your total deductions exceed the tax savings from the lower rates in the new regime.

Choose the New Tax Regime If:

- You do not have many deductions or exemptions to claim.

- You prefer a simpler tax filing process without investment-linked commitments.

- Your income falls within the middle tax slabs where the new tax regime offers a lower tax burden.

Frequently Asked Questions (FAQs)

1. What is the main difference between the Old and New Tax Regimes?

The Old Regime allows deductions and exemptions, whereas the New Regime offers lower tax rates but eliminates most deductions.

2. Can I switch between the Old and New Tax Regimes every year?

Yes, salaried individuals can switch between regimes each year while filing their ITR. However, business owners must stick to one regime unless they discontinue their business.

3. Which tax regime is better for salaried employees?

It depends on their deductions. If they claim multiple deductions like 80C, HRA, and home loan interest, the Old Regime is beneficial. If not, the New Regime may be a better choice.

4. Are standard deductions allowed in the New Tax Regime?

Yes, as of Budget 2023, a standard deduction of ₹50,000 is available for salaried individuals and pensioners under the New Tax Regime.

5. Does the New Regime apply to freelancers?

Yes, freelancers can opt for either regime. However, they cannot switch every year like salaried individuals if they choose the New Regime.

6. Will I get tax benefits on home loans under the New Regime?

No, the home loan interest deduction under Section 24(b) is not available in the New Regime.

7. Can I claim medical insurance under Section 80D in the New Regime?

No, deductions under Section 80D for health insurance premiums are only available in the Old Tax Regime.

8. How do I decide which tax regime to choose? Compare your total taxable income under both regimes. If you have significant deductions, the Old Regime is beneficial. If not, the New Regime may offer lower tax rates

Check This Article: Income tax refund not yet received

Conclusion

There is no one-size-fits-all answer when choosing between the old and new regimes for FY 2025-26. If you are someone who maximizes tax-saving investments and deductions, the old tax regime may be more beneficial. However, if you prefer a hassle-free tax filing experience with lower rates, the new tax regime could be the better option.

To make an informed decision, calculate your taxable income under both regimes using a tax calculator and choose the one that results in lower tax liability. Consulting a tax professional can also help you optimize your tax planning.

Which tax regime do you prefer? Let us know in the comments below!