We have already entered in the new financial year i.e., 2023-24 and you may start getting emails from the Accounts Department of your office that you are required to submit your Tax declaration and opt for the particular Tax regime for the current year. As we know that we have two options for Tax regimes. Old Tax Regime and New Tax Regime. Selecting one of them is quite tricky as we do not know which tax regime will be beneficial for us.

You can refer to this article to decide whether to opt for the Old tax regime or the New tax regime.

What is a Tax slab?

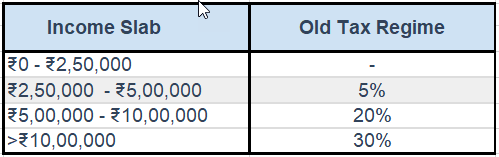

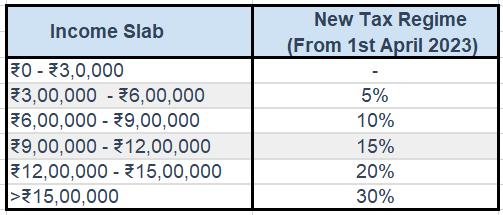

As per the Income Tax Act, when an individual earns taxable income more than the basic exemption limit, he/she is required to pay income tax to the government. To charge tax on such income the Indian government has implemented slab-wise taxability. The income is divided into respective slabs and different tax rates are levied.

What is the Old tax regime?

Earlier there was only one tax regime. In the Union Budget 2020-21, New Tax Regime was introduced by the government. As the new tax regime came into play, the existing tax regime got its name as the Old tax regime. From the year 2023-24 old tax regime will be set as an optional tax regime.

What are the advantages of the old tax regime?

- This regime allows you to claim the benefit of tax-saving investments, deductions, exemptions, and allowances. E.g., 80C,80CCD,80E,24(b) etc

- This regime encourages a taxpayer to do tax saver investments for better tax planning. Such investment not only generates interest income but also helps with wealth creation.

- Since the inflation rate is always on an increasing trend, long-term tax saver investments helps in beating the inflation rate in the coming future.

What are the disadvantages of the old Tax regime?

- Tax rates are on the higher side as compared to the new tax regime.

- There is a monetary limitation of investment amounts to get the benefit of deduction under different income tax sections.

- There are very limited choices for tax-saving schemes.

- Since we are claiming deduction benefits we are required to maintain a proper record of all receipts. Documentation proof is a must.

- Tax-saving investments are subjected to a lock-in period.

What is the new tax regime?

With the introduction of the New tax regime, the existing Tax structure was redesigned, distinguishing between the Old and New Tax regime. A new tax regime was introduced with the purpose to simplify taxation. From the year 2023-24, the new tax regime will be set as the default tax regime.

What are the advantages of the new tax regime ?

- There is no requirement to invest money under any tax saver schemes as these investments do not get accounted for under the new tax regime.

- For tax computation, there is an increased number of income slabs with lower tax rates as compared to the old tax regime.

What are the disadvantages of the new tax regime?

- Under this tax regime, we are not allowed to claim different deductions under a different section of income tax.

- For tax calculation purposes, under the old tax regime, there are only 3 income slabs and corresponding tax rates, whereas, under the new tax regime, there are 5 income slabs and corresponding tax rates so the tax calculation part under the new tax regime is a bit extended.

Comparative Analysis: Which tax regime is better under different income bases?(Below calculation varies from case to case)

Explanation:

Case 1: For a taxpayer who is not going for any tax-saving investments and whose Income is up to 7 lakhs then the New Tax regime is beneficial.

Case 2: For a taxpayer who is investing under different sections in limited amounts i.e. not availing full deduction limits due to short investments and having income less than 15.5 lakhs then the New Tax regime will be beneficial.

Case 3: A taxpayer who can do the maximum possible tax-saving investments like Home loan, LIC, PPF, Mediclaim, NPS, etc. then the Old Tax regime is beneficial for him as he can claim the benefit of all these deductions.

Case 4: If a taxpayer is more into dealing in the share market and does not want to invest under any different income tax deductions then obviously new regime will be more beneficial.

*Above calculations are entirely dependent on a case-to-case basis e.g. current income level, salary structure, and investment/deductions under different income tax section

Summary :

From the above points, it can be concluded that choosing between the Old and New Tax Regimes is influenced by a variety of factors. Both Tax Regimes have their benefits and drawbacks.

The adoption of old or new tax regimes has been kept optional. Even after submitting your tax declarations to the company, your TDS got deducted under the new tax regime and now you want to change the tax regime or vice versa, then at the time of ITR filing you can make the final selection and re-compute the tax liability. Once ITR is filed with a particular tax regime selection, the tax regime option cannot be changed/revised with another option. Also, note if in the previous year, you filed your taxes under the Old tax regime and now in the current year you want to go with the New tax regime, you can accordingly make the selection for each year.

Hope we were able to help you with our tax analysis.

Very helpful