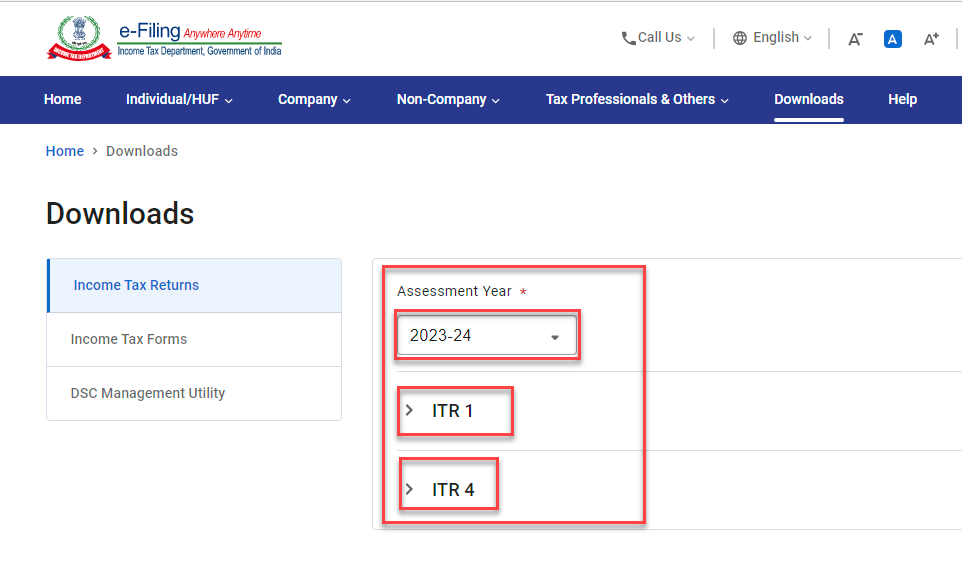

Are you ready to file your income tax return for the financial year 2022-23. The tax filing season has started. The income tax department has released the JSON schema of ITR-1 and ITR-4 for the financial year 2022-23.

Benefits of early filing of income tax return..!!

- Last minute filing errors can be avoided

- Faster processing of ITR

- Refund will be issued early

- By filing your income tax return within the due date you can avoid the late filing fees and interest

- The ITR filed can be reviewed for any corrections to be done and revision of ITR can be filed within time

To whom ITR-1 is applicable ?

For resident individuals having total income up to Rs 50 Lakhs and who are earning income under the head salary, one house property, other sources and agricultural income up to Rs 5000

To whom ITR-4 is applicable ?

Resident Individuals, HUF and Partnership Firms having total income up to Rs 50 Lakhs and who are earning income from business & professional u/s. 44AD, 44ADA or 44E and agriculture income up to Rs 5000.

You can download the ITR-1 and ITR-4 schema from the below link:

https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns

Be ready with below information and documents..!!

- PAN, Aadhar, Bank details

- Form 16

- Form 16A, Form 16B and Form 16C

- Investment proofs

- Annual Pension amount

- Annual rental income

- Annual other sources of income-Interest, Dividend etc.

- Bank statement for the period April 22 to March 23

Sooner the better, be vigilant and get your tax returns filed at earliest. Be an early filer..!!