As the new financial year begins and some new tax regime come into play, a lot of people are wondering how they can save more money on taxes. The Indian government came up with a new tax system, called the “new tax regime,” to make things simpler. It offers lower tax rates, which sounds great at first—but there’s a catch.

This new system doesn’t allow many of the usual tax breaks (like deductions and exemptions) that people used to count on. But don’t worry—if you plan smartly, you can still save a good amount of tax. It’s just about knowing what options are available and using them the right way.

Why the need of New Tax Regime ?

The new tax regime was introduced to give Taxpayers a choice to choose between the old and new tax regimes, allowing them to select the one that benefits them the most.

The new regime simplifies tax compliance by reducing the number of tax slabs and providing a more straightforward tax calculation process thereby reducing chances of Tax Litigation. Since the tax rates under new regime are less as compared to old regime, such reduction in tax rates has increased disposable income in the hands of taxpayers.

The new regime aims to boost economic growth and increase investment. Overall, it is designed to provide a more taxpayer-friendly and efficient tax structure, promoting economic growth and increasing compliance.

Key Tax Benefits Under the New Regime (FY 2025–26)

Standard Deduction – ₹75,000

Salaried individuals and pensioners can claim a standard deduction of ₹75,000 without needing to submit any documentation. This is an increase from the previous ₹50,000, providing immediate tax relief.

Section 80CCD(2) – Employer’s NPS Contribution

Under this section, you can claim a deduction for your employer’s contribution to your National Pension System (NPS) account. The deduction limit is up to 14% of your salary (basic plus dearness allowance) for central government employees and up to 10% for others.

Section 87A Rebate – Up to ₹60,000

If your taxable income does not exceed ₹12 lakh, you’re eligible for a rebate under Section 87A. This rebate can reduce your tax liability by up to ₹60,000, effectively making income up to ₹12 lakh tax-free.

Family Pension Deduction – ₹25,000

Recipients of family pension can claim a deduction of ₹25,000 or one-third of the pension amount, whichever is less. This is an increase from the previous limit of ₹15,000.

Salary Restructuring

Consider restructuring your salary to include components like employer’s NPS contributions, which are deductible under Section 80CCD(2). You can suggest to your HR that your salary package include NPS contributions from the employer side, which helps save tax under Section 80CCD(2)Additionally.

NPS stands for National Pension System, which is a retirement savings plan backed by the government.

Now, here’s the cool part: When your employer puts money into your NPS account, you don’t have to pay tax on that amount—it’s deductible under Section 80CCD(2). That means it reduces your taxable income, and you pay less tax.

Reimbursements from the employer

Many companies include different types of reimbursements in your salary package (also called CTC). These are amounts your company will pay you back if you spend on certain things for work and show the bills as proof.

Some common examples are:

- Fuel and travel

- Driver’s salary

- Mobile phone and internet bills

- Books, newspapers, and magazines related to your work

If you give proper bills for these expenses, you don’t have to pay tax on that part of your salary—this applies to both the old and new tax regimes.

Utilize Tax-Exempt Allowances

Certain allowances remain exempt under the new regime, such as:

Gratuity: Up to ₹20 lakh is exempt under Section 10(10).

Voluntary Retirement Scheme (VRS): Up to ₹5 lakh is exempt under Section 10(10C).

Gifts: Monetary gifts up to ₹50,000 are exempt.

Contributions to Agniveer Corpus Fund

The contributions made to the Agniveer corpus fund by individuals and the Central Government are eligible for tax deductions under 80CCH. All individuals who have enrolled on the scheme on or after November 1, 2022, can claim the benefits.

The fund provides a lump sum amount to Agniveers, helping them transition to civilian life and pursue their future endeavors. The sum of money received from the Agniveer corpus fund after completing four years of service is tax-exempt.

Interest on Home Loan for Let-out Property

Under the new tax regime, homeowners with let-out (rented) properties can claim deductions on home loan interest payments. You can claim a deduction for the entire interest paid on a home loan for a let-out property. There’s no upper limit, unlike the ₹2 lakh cap for self-occupied properties under the old regime.

However, the deduction is restricted to the amount of taxable rental income.

Calculation of Home Loan Interest Deduction Under New Tax Regime (Let-Out Property Only)

Note: Under the new tax regime, you can claim a deduction on home loan interest only for let-out (rented) property, and only up to the amount of rental income received.

If you pay more interest than the rent you earn (like in Scenario 2, where the extra ₹1,00,000 is a loss), you cannot adjust this loss against any other head of income like salary or business.

Also, you cannot carry forward this loss to future years—it simply cannot be claimed.

Key Points to Remember

- Compare regimes every year. The new regime is simpler but gives no deductions/exemptions (except NPS & EPF employer contribution).

- Old regime might save more if you use many deductions.

- Plan your tax-saving investments at the beginning of the financial year to avoid last-minute decisions.

- Choose tax-saving investments based on your goals and risk profile, such as ELSS funds, PPF, and NPS.

- Consider consulting a tax professional to ensure you’re taking advantage of all eligible deductions and exemptions

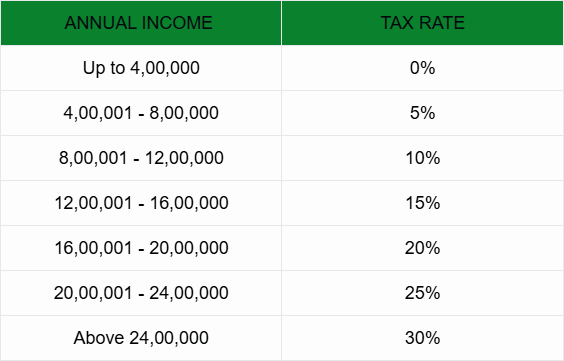

Revised Income Tax Slabs Under New Regime (FY 2025–26)

Note: With the enhanced standard deduction and Section 87A rebate, individuals with income up to ₹12 lakh can potentially have zero tax liability.

Conclusion

While the new tax regime offers fewer deductions compared to the old regime, it compensates with lower tax rates and simplified compliance. By leveraging available deductions like the standard deduction, employer’s NPS contributions, and the Section 87A rebate, you can effectively minimize your tax liability. It’s advisable to analyze your income and expenses to determine which regime, old or new, aligns best with your financial goals.